Nepal is quickly embracing digital technology, and cashless payments are becoming more popular. Two key systems driving this change are PSOs (Payment System Operators) and PSPs (Payment Service Providers). These tools make buying and selling easier, faster, and more convenient for businesses and customers.

Whether you’re shopping at a local store, paying for groceries, or sending money to someone, POS and PSP systems are there to help. Let’s explore what these terms mean and how they are helping Nepal become a cashless economy.

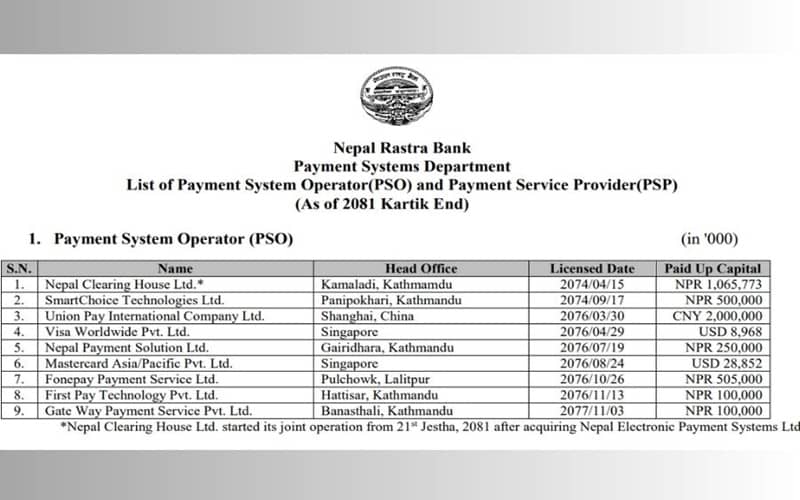

PSO (Payment System Operators)

Payment System Operators (PSOs) are organizations that manage and operate payment infrastructures. They make sure that payment systems like card networks, QR codes, and fund transfers work seamlessly. PSOs provide the backbone for banks, merchants, and PSPs to connect and process payments efficiently.

Key Features of PSOs in Nepal:

- They handle large-scale payment systems like card networks and QR codes.

- Ensure transactions between banks, PSPs, and businesses are smooth.

- Provide secure and reliable payment platforms.

Popular PSOs in Nepal:

- Fonepay: A leading PSO offering interoperable QR code payments.

- Nepal Clearing House Limited (NCHL): Manages systems like connectIPS and NCHL-ECC for digital transactions.

- Visa and Mastercard Networks: Facilitate card-based transactions across the country.

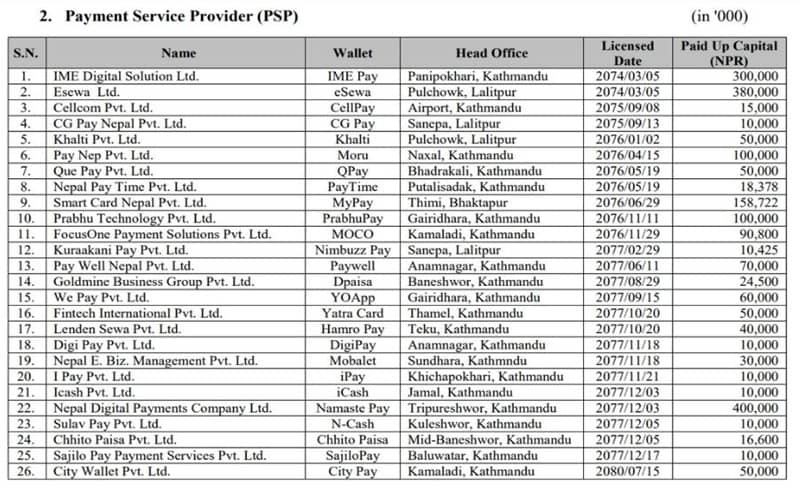

PSP (Payment Service Providers)

Payment Service Providers (PSPs) make digital payments accessible to individuals and businesses. They work with PSOs to provide tools like mobile wallets, QR codes, and online payment platforms. PSPs make it easy for you to pay bills, shop online, or send money with just a few taps on your phone.

Key Features of PSPs in Nepal:

- They focus on delivering services to customers and businesses.

- Offer digital wallets, online payment gateways, and QR code scanning.

- Enable cashless transactions through apps and websites.

Popular PSPs in Nepal:

- eSewa: Nepal’s first digital wallet for payments, transfers, and more.

- Khalti: A simple and user-friendly wallet for daily transactions.

- IME Pay: Strong in remittance and utility payments.

- Prabhu Pay: Focuses on making payments accessible across Nepal.

How PSOs and PSPs Work Together

PSOs provide the payment infrastructure, while PSPs connect customers and businesses to this system. For example, when you scan a QR code through an app like eSewa or Khalti, the PSO (like Fonepay) ensures the payment is processed smoothly.

Why Are They Important in Nepal?

- Help businesses go cashless.

- Make payments faster and more secure.

- Expand financial access, especially in rural areas.

Nepal is on its way to becoming a cashless society, and the combined efforts of PSOs and PSPs are paving the way.

Also, check